Hitherto the domain of Financial Institutions and Hedge Funds, alternative investments

have become more mainstream in the recent years. From HNIs to retail investors,

alternative investments are gaining popularity among all.

what are Alternative Investments?

Simply put, Alternative Investments are those investments which do not include a

long position in traditional assets such as bonds, equities and mutual funds.

While evaluating investment options, you may have heard about diversification and

risk-return trade-off. Diversification or keeping a variety of different assets

in your portfolio helps reduce the volatility of returns from your holdings and

protects your portfolio in case one type of investment loses money while another

remains stable or gains.

Diversification: Alternative investments are non-traditional

ways to broaden your portfolio, and they might help you make money when traditional

investments are losing ground. The investment approach of alternative investments

are very different from that of traditional equity or fixed income investments.

This approach may involve holding both long as well as short positions, using hedging

strategies and also investing in illiquid investment vehicles. Investors using alternatives

may also have a goal of achieving a specific level of absolute return as opposed

to relative performance versus an index.

Due to their low correlation to traditional investments, alternative investments

can potentially enhance diversification and reduce risk. As they are more flexible

and offer a wider investment opportunity, they can potentially enhance return and

can be used to hedge certain portfolio exposures, thereby reducing concentration

risk. Due to this their risks and characteristics are different from those of traditional

investments. On the other hand, they are often less liquid, mostly in periods of

stress; they are generally known to be more complex and less transparent, which

makes them difficult for untrained investors to understand.

While alternative investments on their own may have higher volatility than more

traditional investments, particularly fixed income, they typically have low correlations

to more traditional asset classes. As such, their inclusion in an investment portfolio

tends to result in overall lower volatility.

Protection in Economic Downturns: Traditional equities, bonds

and mutual funds are subject to bull and bear market cycles. Real estate too has

its downturns. The 2008 bear market dropped in tandem with severe corrections in

the real estate sector as well, leading to widespread erosion of investor wealth.

During this time, however, some players in alternative investments managed to post

healthy returns.

Higher Returns - Because they have a wider universe for investment and do not have

some of the same investment constraints (can short and hedge), alternative investments

have better potential for higher returns than traditional investments. Since investors

are looking to increase expected returns or have achieved their investment targets

in traditional assets, optional avenues into alternative investments are gaining

popularity.

Risks associated with Alternative Investments There are

several risks associated with alternative investments above and beyond those typically

associated with traditional investments. Hence, investors should select only those

investments where the underlying risks are well understood.

- Complicated Structures - they characteristically have more complicated

structures in their attempt to achieve consistent or higher returns, may be difficult

to understand for the lay investor and hence call for higher due diligence.

- Less Liquid - Certain types of alternative investments may have

limited liquidity.

- Higher Fees - Given their specialized nature and objective of

providing higher absolute returns as compared to traditional investments, they typically

charge higher fees.

What are the Alternative avenues available today?

Here we keep our discussion limited to examples that are more readily available

to investors in India and are relatively easier to understand and access. These

are classified as Alternative Investments given that these avenues do not frequently

fall under the consideration set for most investors and go beyond stocks, bonds

and mutual funds. However, they have their own merits and it may be helpful to gain

an understanding into these instruments or investment vehicles.

Exchange Traded Funds (ETFs)

Real Estate Investment Trusts (REITs)

Commodities

Structured Products

Private Equity

The following sections provide brief introductions to the four categories.

Exchange Traded Funds (ETFs)

Exchange Traded Funds (ETFs) are essentially Index Funds

that are listed and traded on exchanges just like stocks. Moreover, they can be

bought or sold anytime during the market hours at prevailing price, through terminals

across the country. An ETF is a basket of stocks that reflects the composition of

an Index, like CNX Nifty or BSE Sensex. A key differentiating factor in favour of

ETFs is that their expense ratio is lower, therefore its cost of portfolio administration

is even lower than the index funds. It is one such investment option that helps

you beat inflation.

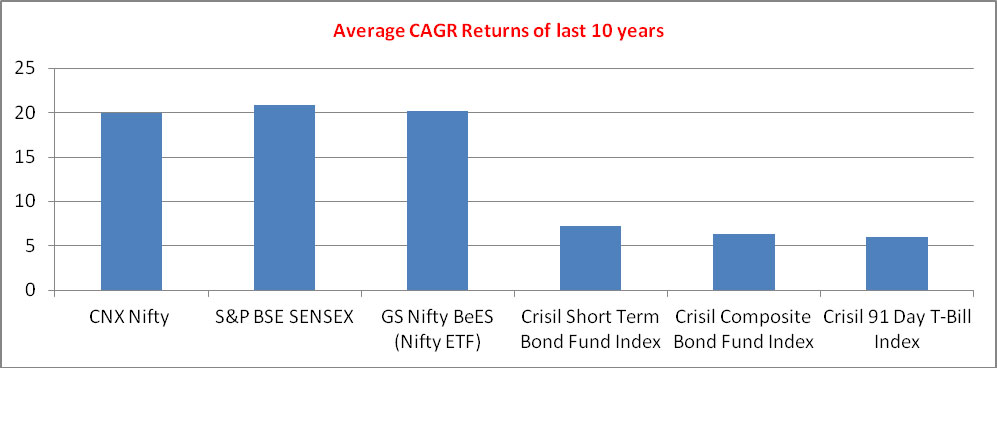

Average returns on equities in the last 10 years have been in the around 20% compounded

annually, while on fixed income instruments it has been 6-7% (see chart below).

Inspite of the higher return delivered, investing in equities has its own challenges.

On the other hand while fixed income instruments like government bonds or fixed

deposits are relatively safer, the returns delivered may not beat inflation. Whereas,

ETFs (refer GS Nifty BeeS in the chart below) has delivered returns comparable to

benchmark indices and are much simpler for the lay investor to understand and invest

in.

Globally, ETFs have opened a whole new panorama of investment opportunities to retail

as well as institutional money managers. Because of its distinct advantages, ETFs

have emerged as one of the most popular asset classes amongst the Investor community

across globe, including India.

However, as every coin has two sides, there are also some disadvantages associated

with ETFs too. For instance, underlying volatility, SIP in ETFs is not readily available,

you can't automatically re-invest your dividends and comparatively lower liquidity

as the market has still not caught up on the concept.

Real Estate Investment Trust (REIT)

Real Estate Investment Trust (REIT) is a company that

owns or funds income-producing real estate investment. It offers regular income

streams, diversification and long-term capital appreciation to all types of investors.

REITs usually pay out all of their taxable income as dividends to shareholders.

In turn, shareholders pay the income taxes on those dividends. Under REITs, the

investors benefit a share of the income earned out of real estate investment, wherein

they do not have to actually buy or finance a property to invest.

REITs let investors to put in money in portfolios of large-scale properties through

the purchase of stocks. REITs are generally traded on major stock exchanges; however,

there are many REITs which are public, non-listed and private. The two main types

of REITs are Equity REITs and Mortgage REITs. Equity REITs make income through the

collection of rent on, and from sales of, the properties they own for the long-term.

Mortgage REITs, as name suggests, invest in mortgages or mortgage securities tied

to commercial and/or residential properties.

Commodities

Commodities are homogeneous goods available in large

quantities, such as energy products, agricultural products and metals. They can

be categorized on the basis of their emphasis on futures contracts, physical commodities,

or both.

Futures contracts refer to traditional futures contracts, as well as closely related

derivative products, such as forward contracts and swaps. Futures contracts are

regulated distinctly and have well defined economic properties. For example, the

analysis of futures contracts typically emphasizes notional amounts rather than

the amount of money posted as collateral or margin to acquire positions.

Commodities as an investment class refer to investment products with somewhat passive

(i.e., buy-and-hold) exposure to commodity prices. This exposure can be obtained

through futures contracts, physical commodities, natural resource companies, and

exchange-traded funds.

A recommended approach to investors new to commodities, is to start with research

on selected commodities and invest in smaller contract sizes.

Structured Products

Structured Products are synthetic investment instruments

specially created to meet specific needs that cannot be met from the standardized

financial instruments available in the markets. Structured products can be used

as an alternative to a direct investment, as part of the asset allocation process

to reduce risk exposure of a portfolio, or to utilize the current market trend.

Structured products are instruments created to exhibit particular return, risk,

taxation, or other attributes. These instruments generate unique cash flows resulting

from a partitioning of the cash flows from a traditional investment or by linking

the returns of the structured product to one or more market values.

Private Equity

Private Equity lets you invest in up-and-coming companies

that are not yet public or listed on stock exchanges. They can give excellent returns;

however they call for thorough research into the potential of the company's business

and patience to hold on to one's investment since money might be tied up for years

until an exit opportunity is available. Exit opportunities usually come through

the company's listing or through sale of one's holdings to another private investor.

How Can Way2Wealth Assist?

We scan the market place for well performing alternative investment funds (AIFs)

and new opportunities on a regular basis. This exercise helps our clients evaluate

the best performing funds for their investment consideration. We regularly interact

with AIF managers and pass on relevant updates to interested clients. We monitor

the performance of the short listed AIFs to ensure the efficiencies can be measured.

Periodic reporting on the performance of the AIFs are prepared and shared with clients.

We advise clients on timely entries & exits into/out of the AIFs and can negotiate

good terms for the investing clients.

With specific reference to the avenues mentioned earlier, here are some pointers:

- ETFs- Investing in ETFs is quite simple and only requires a

simple trading/investment account with a broker like us. Investors can buy and sell

Index or Gold ETFs similar to stocks.

- REITs- We bring quality issues to clients after in-house due

diligence on the investment worthiness of REIT issuances in the market.

- Commodities- We can facilitate delivery settlement of exchange

traded commodities. Given our knowledge and expertise in physical commodities, we

can advise and execute procurement and warehousing of physical commodities and if

desired, arbitrage physical commodities using futures contracts in commodities traded

on the exchange platforms.

- Private Equity- Through our close relationships with investment

bankers, we bring private investment opportunities from time to time for our HNI

clients, who have some background to investing in this area.